Books to Get You Thinking…

It seems that the signs of a rapidly shrinking economy are all around us. Every day brings more bad news. What are the underlying causes of this crisis? What can be done to put the economy back on track? Are we facing a return to the Great Depression of the thirties? If you’re looking for answers, your library system has several books that you can delve into…

Another thought-provoking book I found on our shelves is “The Great Inflation and its Aftermath: the Past and Future of American Affluence”. The author is Robert Samuelson, a long-time columnist for the Washington Post as well as Newsweek. Published in November 2008, the book analyzes the interrelationships between the economic events spanning the last five decades and the current breakdown of the financial markets. The premise of the book is that the economic performance is shaped not just by macro indicators such as interest rates, prices and technology innovations but also by economic institutions, ideas and values.

Another thought-provoking book I found on our shelves is “The Great Inflation and its Aftermath: the Past and Future of American Affluence”. The author is Robert Samuelson, a long-time columnist for the Washington Post as well as Newsweek. Published in November 2008, the book analyzes the interrelationships between the economic events spanning the last five decades and the current breakdown of the financial markets. The premise of the book is that the economic performance is shaped not just by macro indicators such as interest rates, prices and technology innovations but also by economic institutions, ideas and values.

Reserve this Book

The Two Trillion Dollar Meltdown by Charles Morris, first published in 2008 as the Trillion Dollar Meltdown is a fascinating book that pieces together all the different elements of policy as well as the financial instruments and practices dating over the last decade that eventually led to the collapse of the credit markets and the economic system. Morris sees the subprime mortgages as just the beginning of a financial meltdown. He estimates a sum of two trillion dollars would be needed to cover the write-offs and defaults of failing assets and put the economy back on track. Though heavy in its use of financial terminology, the author does an excellent job of explaining a complex subject in a way that addresses both the general reader as well as the specialist.

The Two Trillion Dollar Meltdown by Charles Morris, first published in 2008 as the Trillion Dollar Meltdown is a fascinating book that pieces together all the different elements of policy as well as the financial instruments and practices dating over the last decade that eventually led to the collapse of the credit markets and the economic system. Morris sees the subprime mortgages as just the beginning of a financial meltdown. He estimates a sum of two trillion dollars would be needed to cover the write-offs and defaults of failing assets and put the economy back on track. Though heavy in its use of financial terminology, the author does an excellent job of explaining a complex subject in a way that addresses both the general reader as well as the specialist.

Reserve this Book

There are many more exciting titles on our shelves, so be sure to check back for more books to get you thinking!

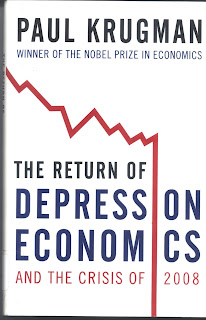

Many of us know Paul Krugman as a prolific New York Times columnist. He is also a Nobel Laureate and a faculty member at the Department of Economics, Princeton University. In his most recently published book, The Return of Depression Economics and the Crisis of 2008, Paul Krugman analyzes the current global financial crisis and details the steps that can be taken to reverse the downward spiral of income and employment and a shrinking worldwide economy. What is fascinating is that Krugman had published an earlier work in 1999 that dealt with the faltering economies of Latin America and East Asia in the eighties and nineties. Now after more than a decade of soaring growth rates, the United States faces an economic crisis far worse than the East Asian countries had faced back then, but Krugman artfully shows the parallels to be drawn and lessons to be learned from the past.

Another thought-provoking book I found on our shelves is “The Great Inflation and its Aftermath: the Past and Future of American Affluence”. The author is Robert Samuelson, a long-time columnist for the Washington Post as well as Newsweek. Published in November 2008, the book analyzes the interrelationships between the economic events spanning the last five decades and the current breakdown of the financial markets. The premise of the book is that the economic performance is shaped not just by macro indicators such as interest rates, prices and technology innovations but also by economic institutions, ideas and values.

Another thought-provoking book I found on our shelves is “The Great Inflation and its Aftermath: the Past and Future of American Affluence”. The author is Robert Samuelson, a long-time columnist for the Washington Post as well as Newsweek. Published in November 2008, the book analyzes the interrelationships between the economic events spanning the last five decades and the current breakdown of the financial markets. The premise of the book is that the economic performance is shaped not just by macro indicators such as interest rates, prices and technology innovations but also by economic institutions, ideas and values.Reserve this Book

The Two Trillion Dollar Meltdown by Charles Morris, first published in 2008 as the Trillion Dollar Meltdown is a fascinating book that pieces together all the different elements of policy as well as the financial instruments and practices dating over the last decade that eventually led to the collapse of the credit markets and the economic system. Morris sees the subprime mortgages as just the beginning of a financial meltdown. He estimates a sum of two trillion dollars would be needed to cover the write-offs and defaults of failing assets and put the economy back on track. Though heavy in its use of financial terminology, the author does an excellent job of explaining a complex subject in a way that addresses both the general reader as well as the specialist.

The Two Trillion Dollar Meltdown by Charles Morris, first published in 2008 as the Trillion Dollar Meltdown is a fascinating book that pieces together all the different elements of policy as well as the financial instruments and practices dating over the last decade that eventually led to the collapse of the credit markets and the economic system. Morris sees the subprime mortgages as just the beginning of a financial meltdown. He estimates a sum of two trillion dollars would be needed to cover the write-offs and defaults of failing assets and put the economy back on track. Though heavy in its use of financial terminology, the author does an excellent job of explaining a complex subject in a way that addresses both the general reader as well as the specialist.Reserve this Book

There are many more exciting titles on our shelves, so be sure to check back for more books to get you thinking!

-Nita Mathur

The current global economic problem has touched everyone's lives. It is in the mind of persons from all walks of life.

ReplyDeleteThe review of these books at such a time is most appropriate. This will give the library users an incentive to get to the books and get updated on the crisis.

I would like to congratulate the MCL in introducing the new blog feature and Ms. Mathur for her effort in selecting, reading and describing these books for us.

S. Chand